Introduction

Securing travel insurance for the USA should be a priority whenever you and your family are planning a trip to the USA. We appreciate that prospect of visiting the sunshine state can be exciting, but it’s also important to think about the potential risks and unexpected events that may occur during your stay. That’s where travel insurance comes in – it provides peace of mind and financial protection in case of emergencies. In this article, we’ll explore why holiday insurance for the USA is important and how to choose the best policy.

Why Is Travel Insurance Important for the USA?

1. Medical Emergencies

Medical emergencies can happen anywhere, and the cost of healthcare in the USA is notoriously high. Travel insurance can cover medical expenses such as hospitalization, doctor visits, and emergency medical transport.

2. Trip Cancellation or Interruption

What if something unexpected happens and you need to cancel or cut short your trip to the USA? Travel insurance can reimburse you for non-refundable expenses such as airfare, accommodations, and activities. Please remember that a lot of insurance policies only cover services such as flights etc which were booked after your cover was in place.

3. Lost or Stolen Belongings

Losing your luggage or having your valuables stolen can put a damper on your trip. Travel insurance can provide coverage for lost or stolen items, including baggage, passports, and travel documents.

4. Personal Liability

Accidents happen, and if you’re found responsible for causing damage or injury to someone else, you could be liable for expensive legal fees and compensation. Travel insurance can cover personal liability, giving you peace of mind and financial protection.

How to Choose the Best Travel Insurance Policy for you

Coverage Limits

Make sure the policy you choose has adequate coverage limits for medical expenses, trip cancellation, and personal liability. Consider your travel plans and the potential risks you may face.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition, make sure your policy covers it. Some policies may exclude coverage for certain conditions or require additional premiums. Remember to be accurate with your answers when completing a travel insurance application, failure to disclose an issue may result in your coverage being denied.

Exclusions and Limitations

Read the policy documents carefully to understand any exclusions or limitations. For example, some policies may not cover extreme sports or activities, or may have exclusions for certain countries or regions.

Price and Value

Compare policies from different providers to find the best value for your money. Don’t just choose the cheapest option – make sure you’re getting the coverage you need at a reasonable price. Always check the costs associated with the various excess fees on many travel insurance policies.

Reputation and Customer Service

Choose a reputable insurance provider with good customer service. Look for reviews and ratings from other travellers to get an idea of their experience.

Have you got Travel Insurance Already?

Some bank accounts have the likes of travel insurance included as part of their products. Unfortunately however many of these do not have the best of cover when it comes to travellers who have a range of health issues and/or for those who are looking to take an extended holiday. Non the less this is something that is worth checking as it may save you having to purchase what you may already have.

Our Florida Travel Insurance

Like many elements of a holiday, travel insurance can be expensive depending on personal circumstances. To reduce the cost to us, we take out annual policies. This is the nest option for us as it is cheaper than buying travel insurance for individual trips. We look for comprehensive cover, which provides use with the confidence and comfort we require.

How we Try to Keep the Cost Down.

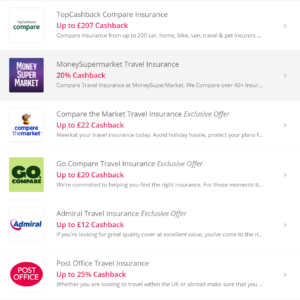

As well as taking out an annual policy, we spend some time online on comparison sites, as well as the likes of TopCashback which has a good variety of travel insurance providers who incentivise their products buy offering a percentage reduction in the cost by way of a cash back option.

These offers do change, so make sure to check the out as soon as you are considering buying your travel insurance. Please also bear in mind that sometimes cashback products are not the best value, it is also worth checking those providers who do not offer cashback.

Conclusion

Travel insurance for the USA is important for protecting yourself and your finances in case of unexpected events or emergencies. When choosing a policy, consider your travel plans and the potential risks you may face, as well as the coverage limits, exclusions, and price. Choose a reputable provider with good customer service for peace of mind during your trip.

FAQs

Is travel insurance mandatory for travel to the USA?

No, holiday insurance is not mandatory for travel to the USA, but it is highly recommended to protect yourself and your finances in case of unexpected events.

What does travel insurance for the USA typically cover?

Travel insurance for the USA can cover medical expenses, trip cancellation or interruption, lost or stolen belongings, and personal liability, among other things.

Can I purchase travel insurance for the USA if I have a pre-existing medical condition?

Yes, some travel insurance policies may cover pre-existing medical conditions, but it’s important to read the policy documents carefully and understand any exclusions or limitations.

How much does travel insurance for the USA cost?

The cost of travel insurance for the USA depends on various factors such as your age, travel plans, and coverage limits. It’s important to compare policies from different providers to find the best value for your money.

Can I purchase travel insurance for just part of my trip to the USA?

Yes, some travel insurance providers offer single-trip policies that can cover just a portion of your trip to the USA. Make sure to check the policy documents and coverage limits before purchasing.

How do I make a claim on my travel insurance policy?

If you need to make a claim on your holiday insurance policy, contact your provider as soon as possible and follow their instructions. Be prepared to provide documentation such as receipts and medical reports.

Is it better to purchase holiday insurance directly from a provider or through a travel agent?

It depends on your preferences and travel plans. Purchasing directly from a provider may offer more flexibility and customization, while purchasing through a travel agent may provide additional assistance and support during your trip.

Can I purchase travel insurance for the USA if I am not a UK resident?

Yes, some travel insurance providers offer coverage for non-UK residents. Make sure to check the policy documents and coverage limits before purchasing.

What should I do if I need emergency assistance while in the USA?

Contact your travel insurance provider as soon as possible for assistance and instructions. If you need emergency medical assistance, call 911 in the USA.

How far in advance should I purchase travel insurance for the USA?

It’s best to purchase holiday insurance before you begin to book your trip to ensure coverage in case of unexpected events or emergencies. Don’t wait until the last minute to purchase, as some policies may have exclusions for pre-existing conditions or require a waiting period before coverage begins.

We have a number of other informative articles that you may find of value ahead of a visit to Florida, such as our guide to the Florida car seat laws, and what you need to know.